Featured image by from Pexels

Well-managed accounts payable can keep you from having to borrow money during leaner times, even if you find it necessary to scale up production. Read on to find out more.

RELATED ARTICLE:

As the famous adage says, you must spend money to make money. Likewise, companies must have enough cash to conduct business and stay afloat. For this reason, purchasing of supplies is a constant in the normal course of business. This translates to inputs that generate revenues and sustain operations.

But there are times when you have to scale up production to keep up with . As such, the resources you have available may not always suffice your business needs. This is where accounts payable can save the day, allowing you to avoid the hassle of borrowing money to pay for the supplies your business requires.

With that in mind, we will discuss how accounts payable function for your business. We will also take a look at some of the industries that most rely on accounts payable.

Accounts Payable in a Nutshell

Accounts payable is a business term that refers to liability to one or more creditors. An account payable is recorded upon receiving goods or services on credit terms. In short, it is an amount your business owes to the suppliers of goods and services your company needs for production.

These are part of current liabilities or those paid within the year. Often, they do not bear interest since these are not debt by nature. Nonetheless, creditors may still add interest, depending on the credit agreement.

While they are a liability, people tend to treat as an expense. In reality, they are a credit entry in the trial balance that gets debited once paid. For example, let’s suppose you pay for your purchased goods of S$500 on a credit term. This is how you will record it: You will debit Accounts Payable S$500 and credit Cash S$500.

Meanwhile, they can help you maintain your working capital for a short period. You may delay paying them to maintain the current amount of your cash on hand. They can also help with liquidity for a short period because you will maintain a larger cash balance. But once you record accounts payable, that status will change. This is because your liquidity ratio depends on your current assets and current liabilities.

How These Accounts Work Across Different Industries

Your cash on hand is not always enough to cover your payment for materials and supplies. As such, it is no wonder that accounts payable are a fundamental part of a company’s core operations. They ensure that you have enough cash and materials for your day-to-day activities. This is even more important when you have to increase your production.

You can incur accounts payable through agreements with your suppliers. But a more efficient way today is through your corporate or business credit card. Let’s say you run out of materials for your product. Your first impulse is to run to the nearest store or supplier to buy what you need and continue the process.

With a credit agreement or corporate card, you can get the materials as soon as you need them. With that, accounts payable works best with companies in the commercial sector. This is a collective term for companies that involve inventories as part of their operations. These can be food companies, pharmaceuticals, sporting goods, and the traditional supply chain.

In short, companies with manufacturing or distribution in their process need accounts payable. Of course, banks and investment companies may also have them, along with inventories as well. Yet, if you compare the amounts, the differences among these industries is noticeable.

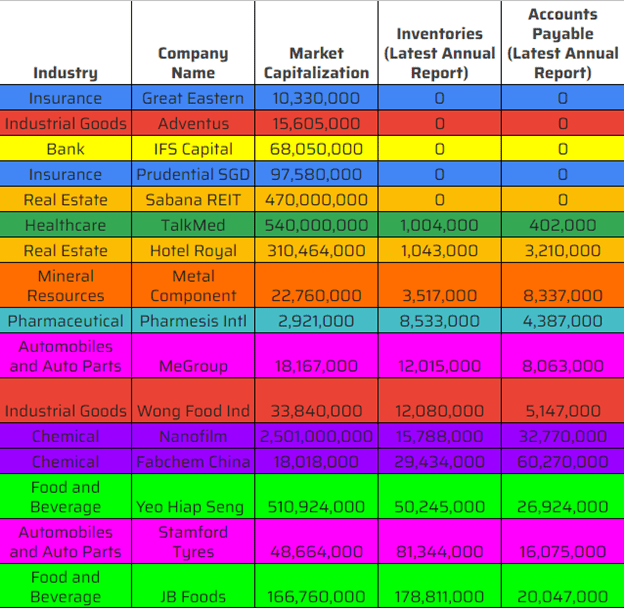

We made a tabular example of some public companies in Singapore, classified according to industry. Note that all values are in SGD.

Table from

We can infer that the companies that use inventories have more accounts payable. This is logical since these companies need materials to produce their finished products. Obviously, accounts payable are common in industries that turn raw materials into finished products. Most of their orders are in bulk and according to credit agreements with suppliers.

To understand this better, check what a company produces. For example, the two insurance companies have no inventory and no accounts payable. In essence, insurance companies create policies from premiums. They earn from their policyholders and investments. They do not need these credit agreements since premiums do not need raw materials.

Meanwhile, banks earn on loans and investments. They may have accounts payable, but the value is lower compared to most other industries. The trend is different in other industries such as food and chemicals. In general, companies in the commercial sector rely on accounts payable.

RELATED ARTICLE:

A Deeper Look at Inventories and Credit Agreements with Suppliers

Assessing inventories and the accounts used to pay for them helps a business maintain its financial position. Inventory is part of current assets, even if it is an operating cost in nature. This is because inventories are sources of revenue. As mentioned, these are composed of supplies you sell and replenish. Meanwhile, accounts payable for purchasing inventories is a liability.

Together they can show a company’s financial standing daily. They can show how efficient your business is in managing and selling products. You can track your inventory turnover or how fast inventories generate revenues. Inventories and accounts payable may appear too high compared to revenues at times. When this occurs you may have to take steps to improve efficiency and stimulate revenue growth.

Also, you can check the proportion of your supplies and credit. This is done by comparing the ending value of accounts payable to inventories. Given this, you can ensure that you are earning enough to pay your suppliers on time. You will know which suppliers may extend credit terms based on your payment standing.

RELATED ARTICLE:

The post appeared first on .