If you’ve been keeping an eye on the US economy in recent years, you might notice that things are looking pretty darned rosy. Unemployment is at its lowest level in 40 years, wages are rising, and house prices have not only recovered from their fiery crash of 2009 – they have had several years of record breaking prices in most regions, just like the stock market.

A current snapshot of how expensive the stock market is – not in sticker price, but in the more instructive price-to-earnings (P/E10) ratio. In all of US history, it has only exceeded this expensiveness once – for the late-1990s bubble. Not something that should make you sell your index funds, but probably a clue about an upcoming bubble-based recession. Image source is the very useful site multpl.com www.multpl.com/shiller-pe/

In short, today’s situation is very similar to what Mr. Money Mustache, despite no magical forecasting skill, forecast back in 2013, in an article called ““. In that post, I suggested that we were in for some very good years, which made it a good time for getting ahead – make hay while the sun shines!

It’s a lot easier to fix your problems right now, with a stiff economic tailwind at your back, than it will be in just a couple of short years (or less?) when the high seas and lighting bolts and whirlpools are ripping at your pockets. Fair weather preparations include:

- Rake in your big paycheck while it lasts and don’t blow it on temporary luxuries

- Keep your living footprint efficient – in expensive cities this is a great time to rent, and not a great time to spring for the sprawling home of your dreams on a big mortgage.

- Eliminate any last shreds of consumer and

- With the stock market at higher price-to-earnings ratio than usual, there is less harm in paying off your mortgage earlier, keeping six months of living expenses in cash or money market funds, and other non-stock investments like rental properties in low-cost cities (where reliable rent is over 1% of total property price per month).

- Design your career and your self-employment side gigs so that they are resilient: multiple streams of income from different sources, and an easy answer for “What would I do if my job or industry ceased to exist?”

Of course, becoming less dependent on a steady job is always a good thing – it just happens to be much easier to build that independence if you’re surfing atop a giant economic wave like this one.

So, Here We Go:

With all those preparations in progress, I hope you’re ready, because there’s a recession on the way.

I can say this with confidence because there’s always a recession coming – we just never know exactly when. About the only thing I can guarantee is that we are about four years closer to the next recession than we were when I wrote that optimistic earlier article.

But it is very important to remind yourself of this, because when we get to this rosy point of the business cycle, things have been so good for so long that we forget that crashes are even possible. If you’re a sagely 27 years old right now, you may have never experienced a recession in your adult life – all you have ever seen is the good times. You’re in for an interesting surprise.

However, on top of that folksy “It always happens” wisdom, there are a few other clues that suggest the time is approaching:

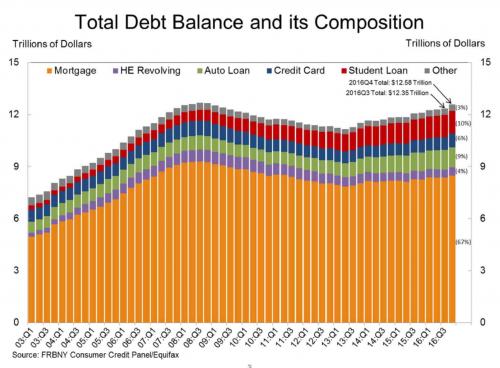

Household debt levels back to their pre-crash peak, and with an even worse composition: more student loans, and a record level of auto loans, the most ridiculous and self-destructive piece of personal finance outside of mortgaging your shins to a loan shark to afford tonight’s cocaine.

Image from the very good Zero Hedge article linked above.

Consumer debt shouldn’t really exist at all – it’s simply a house of cards that allows impatient people to pull their consumption from the future, just a teeeeny bit forward into the present, in exchange for spectacularly bad costs, stress, and wrecking of lives. But because it exists and is profitable, a huge ($1.3 trillion in 2015) financial industry has sprung up to originate, multiply, and churn this debt.

Just like 2007, the financial industry is on top of the world again, with lots of easy money flying around into things like “subprime auto loans”. The Great Recession of that era was caused when the wild packaging and reselling of mortgage debt combined with a false sense of confidence that the party would go on forever.

The final piece of evidence comes from just how long the present party has gone on. If you look at the history of economic expansions – how long we have gone since the last recession – we are currently enjoying the third longest one in history:

When we put all Good Times since WW2 into a graph, you can see just how exceptionally long we have been riding high.

So we’ve had a good run. If we go on to tie the Clinton-era record, that still gives us a maximum of two years until the trouble hits. And if you happen to think that economic success correlates with the level of brainpower currently in the White House, then, hmm.. you can make some adjustments based on that as well.

“OK, But What Actually Causes Recessions? And What will Cause the Next One?”

In succinct terms, recessions are caused when a bunch of people lose confidence all at once.

Usually it starts with a mini-crisis: the prices of stocks and houses have been going up for so long that people forget the opposite can happen. A bunch of testosterone-fueled betting and speculation (often by overconfident and under-regulated junior hotshots on Wall Street) ensues. And in general, speculation is a dumb thing.

If you have ever heard of someone buying something, not because they actually want it or because it produces income, but just because they think it will be worth even more in the future, that’s speculation. When people buy apartments in Toronto and leave them vacant (or rent them out at a loss) in hopes of later selling them to an even , that’s speculation. Speculation leads to bubbles, and bubbles always pop, because there was no rational reason for the prices to get that high in the first place. They also happen frequently in the stock market.

When prices hit some random limit or wobble a bit, the bubble often pops. Everyone gets scared and rushes out to sell, so the prices drop rapidly. Suddenly, over-leveraged novices can’t repay their oversized bank loans and they start missing payments.

Banks get scared of losing all that money, so they tighten up lending, which causes businesses to scale back hiring and expansion, leading to layoffs, which cuts down on consumer spending, which cuts down business profits again, leading to even more layoffs, and the problem feeds upon itself.

Eventually, the prices of these valuable assets gets low enough that people with actual money like you and me perk up and start scooping them up at a discount. A pristine apartment building here, some shares of a few thousand established, profitable companies there via an index fund. This puts a floor under the dropping prices.

Meanwhile, the Federal Reserve Bank also steps in, lowering interest rates and flooding the system with cheap money to encourage people to start buying houses again and businesses to start expanding to soak up the pool of unemployed people. Everyone gets back to work, and the recession ends. Usually very quickly – most recessions last less than one year.

So, as long as you aren’t a Consumer Sucka, commuting to work in a bank-financed gas-powered racing sofa and/or borrowing money for furniture and appliances to outfit that last spare room in your suburban mansion, recessions are a great thing. Housing and profitable investments become cheaper, insanity and speculation is reset, and people actually start living more frugally again, getting back to the roots of what living a good life really means.

Most people who are wealthy today, achieved it by building and acquiring profitable investments in the past, when they were on sale. A recession is just a big sale – on almost everything.

“So, Should I Be Worried?”

No, of course not! This is just money we’re talking about, and you should never be worried about money.

One of the joys of Mustachianism is that it makes you immune to the business cycle. You immediately stop living beyond your means, so you have stepped back from the cliff. Then you start to build a resilient mesh of skills, health, money, friendships, and peaceful personal badassity which further protect you from trouble.

After all: who cares about the price of gasoline, or affording cholesterol pills, or how to make the next truck payment, when you’re a wiry and muscular Mustachian, riding your swift and sensible bike a few miles to work and banking almost all of your enormous paycheck every two weeks?

Then as you live this joyful existence for however many years it takes, the final stage of complete financial independence arrives automatically, and you are absolutely invincible.

Whether it comes in two weeks or four years, I hope all of us are prepared for next hill on this roller coaster – it’s a lot more fun when you know it’s coming.

—-

In the comments: do you care for a wager on when the next “crisis” will hit and we’ll fall into recession again? What will be the thing that gets us this time?